Access issuers globally, expand assurance impact

Maximize the value of second opinions and assurance by increasing transparency and accessibility to results.

Accelerate third party verification and impact assurance

For issuers validated data means showcasing trustworthiness. For investors it means giving reassurance that the invested capital is serving the intended purpose.

Green Assets Wallet's technology support issuers in demonstrating a proven track-record, assuring investors that the underlying data are robust.

The option for external third party verification on our platform adds to this assurance. Our validator interface aligns impact verification with best-practice labelled bond standards.

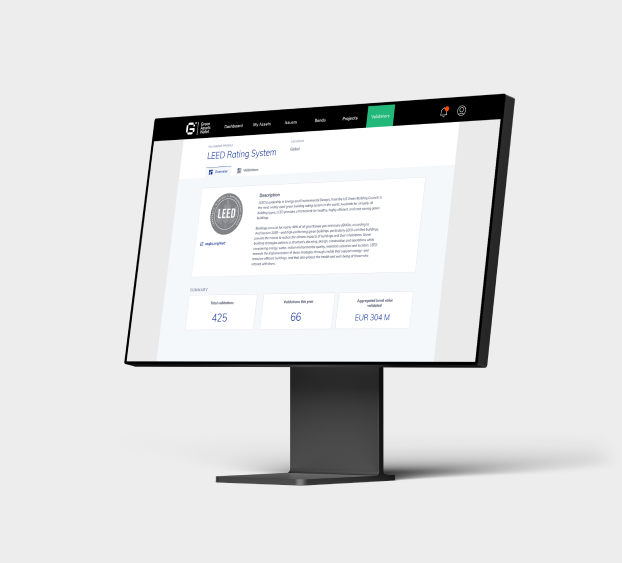

Build a validator profile and engage with clients

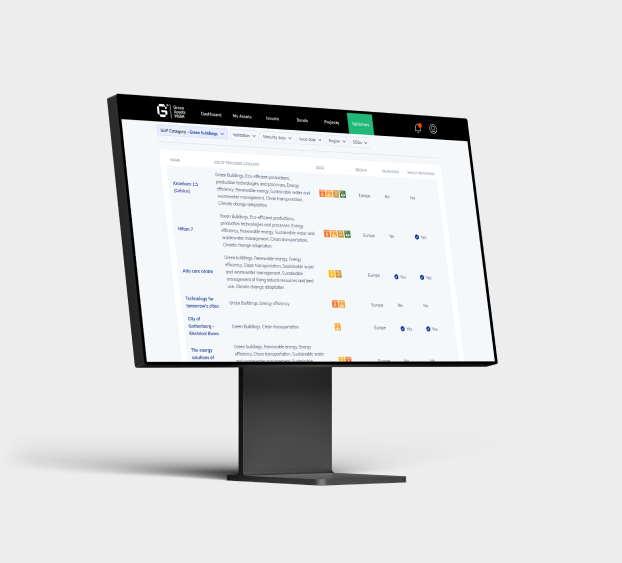

Our platform engages second opinion providers, assurance providers, and certification bodies, offering a better control of framework compliance.

Connect with clients and issuers. As audit reports are automatically delivered to them, you support them in their own impact journey.

Engage in pre- and post-issuance validation. Verify data on entity, framework and project level.

Assurance all in one place

We partner with established and emerging validators of green and sustainable frameworks, reporting guidelines and certification schemes.

Green Assets Wallet simplifies the assurance of data and commitments by storing all your certification and assurance documents in one place.

We also help you aggregate and analyse total verified or assured impact.

We offer

Impact reporting assurance

Accelerate assurance by accessing impact data and digitize the verification process. Our validator interface aligns impact verification with best-practice labelled bond standards.

Validation on multiple levels

Engage in pre- and post-issuance validation. Verify data on entity, framework and project level. Include certificates, remote sensing, digital images and satellite verification.

Digital document repository

Audit reports are automatically delivered to stakeholders, supporting them in their own impact journey. Upload and store second opinions and verification reports on our platform.

Overview of total impact assured

Validators through their profile can showcase their services and impact targets as well as second opinions, aggregation, overview of issuers, projects and the impact assured.

Trusted by transparency leaders

Join our growing network

We are currently onboarding validators, second opinion and assurance providers. If you are interested in becoming a partner, featured on the Green Assets Wallet - contact us today!

Connecting debt capital market participants

Green Assets Wallet is an impact tech company with a mission to re-direct capital flows towards to net zero economies. Our solution injects trust and transparency into the debt capital market ecosystem through a proven methodology and harmonized and validated impact data.

Green finance in Africa

African countries are among the most exposed to climate change, but the continent only sees about 5% of global green/climate investments. Learn how Green Assets Wallet can supports issuers, investors and validators in the region.

FAQ

A validator is an independent organization qualified to verify claims made by issuers, including bond framework documents (second opinion providers), impact reports (assurance providers) and impact data (certification bodies and other independent expert bodies).

Validation in Green Assets Wallet refers to the process by which the Issuer provides proof of delivery on commitments. The commitments refer to promises made to investors about the use of proceeds raised via green debt instruments, and are typically found in the Green Bond Framework or equivalent document.

Currently, the data that are validated on Green Assets Wallet can be seen in the project view column. The issuer selects the verification process today, and it can take the form of a certification from a known standards body. Typically, the data is either a document (a consultancy report, a certificate, an audit, etc), or a photograph (a satellite image or other).

When data is uploaded onto the platform, there is an option to upload a third party validation. This validation can either be uploaded as a document by the issuer or requested from a listed validator by requesting a report on the platform.

When registering a Green Bond Framework and related green bond(s) on Green Assets Wallet the Issuer defines a set of green commitments (based on criteria in the green bond framework and/or other important guiding principles). The commitments that apply to a specific project are chosen and will be subject to follow-up and proof of delivery to investors. E.g. “Installing solar power plants in location X”.

Process for validation of delivery on commitments: When registering a project on Green Assets Wallet, the Issuer defines which green commitments are applicable to the project and how it intends to validate delivery on these commitments. This includes defining what type of proof (for example, a report, a satellite photo, etc.) that will be provided, and what entity will provide the proof (either a third party, or the issuer). These promises of data to be provided are stored on the blockchain and visible to investors.

Validation of delivery on commitment is met: The pre-defined proof of delivery on a commitment is submitted by the authorised entity (either the issuer or a third-party validator). The data object is stored on the blockchain and visible to investors. For example, satellite footage of solar panels.

No, the Green Assets Wallet does not sign off on the trustworthiness or quality of the information provided in the Validation section. The Green Assets Wallet cannot take responsibility for the quality of the data submitted by a user. It provides a system for actors to exchange information in a transparent manner but it doesn’t take away responsibility from any user.

The Issuer is responsible for submitting relevant and quality data and should be incentivised to do so, as it will be stored in a transparent way on the blockchain. Investors have the responsibility to make their own judgement on the relevance and quality of the information provided by the Issuer. The Green Assets Wallet provides space for Issuers to ask third party “validators”, such as audit firms, expert bodies, etc to submit validation data in order to strengthen the credibility of the Validation. What validator that has provided the validation is visible to investors on the project profile.

Currently, the data that are validated on Green Assets Wallet can be seen in the project view column. The issuer selects the verification process today, and it can take the form of a certification from a known standards body. Typically, the data is either a document (a consultancy report, a certificate, an audit, etc), or a photograph (a satellite image or other).

Green Assets Wallet originated as a collaboration of major industry leaders and experts in sustainability, green finance and academia. The initiative since then gathered leading global market participants, such as investors, issuers, and researchers. Since our launch as a company in early 2020, we have partnered with major financial market key players, and we are working with the most reputable bond and impact experts. Get in touch at the bottom of this page.

To upload validation on Framework level in the Green Assets Wallet, an issuer can use assurance documents that already are in place in today’s green bond market. These can be uploaded under “Supporting Documentation” on the issuer profile. This assurance is usually performed by an audit firm and at aggregate (bond/portfolio) level. The project validation in the Green Assets Wallet adds value as it provides greater transparency and more detailed level information about underlying projects.

For issuers that cannot reveal their project specific data, the framework level Assurance document will be very important. For other actors it might be fully possible to provide validation of all projects. The ambition is that the Green Assets Wallet should be flexible enough to accommodate the different needs and situations of the actors in the market.