The $100 trillion challenge to save planet Earth

Financing net-zero economies is a rare opportunity to improve lives and achieve high-impact returns.

Capital markets hold the key

The world faces unprecedented challenges: Climate change, population growth, and resource scarcity. The need for governments, financial institutions, and corporations to act is well-known.

Current disclosure of climate change strategies, the incomplete assessment of climate risks, and inconsistent data on transition paths raise questions, as are current efforts which are not enough to halt the crisis.

Green Assets Wallet is designed to inject efficiency and transparency into the debt market and unleash capital at scale. Our objective is to accelerate capital markets for sustainable investments using emerging technologies in support of the UN Sustainable Development Goals and the Paris Agreement.

The labelled bond market is growing

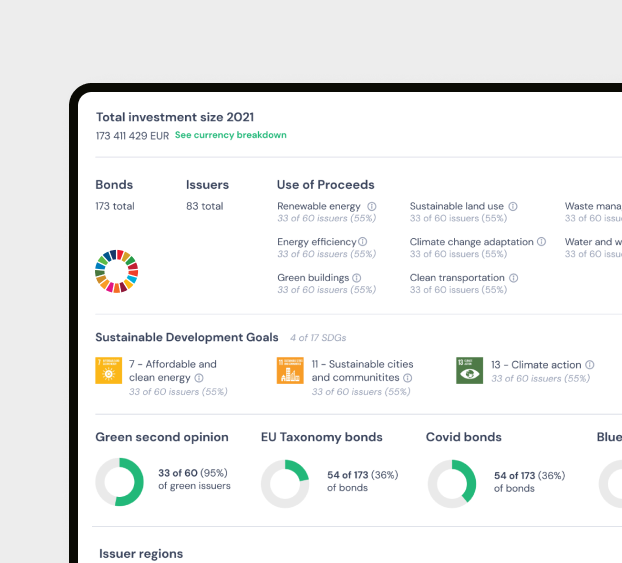

Investor interest is picking up. As of October 2021, the green bond market reached a total issuance of USD 0.44 trillion while the overall labelled bond market reached an all time high of USD 0.97 trillion.

All in all this is still miniscule compared to the total global long-term bond issuance of USD 27,3 trillion. The total debt portfolio must be re-directed to support the transition needed.

Regulations can motivate market participants to finance the right projects and investments, but investors also need credible impact data and harmonized reporting frameworks.

Market challenges

No common reporting standard

Impact reporting has traditionally focused on qualitative information. Impact calculations and metrics are evolving, while data collection techniques and methodologies have proliferated during the past years.

Not aligned with investor needs

It is difficult to price-in impact and ESG performance when choosing investments. Transparent, meaningful and accessible impact data allows investors to align their investments with their impact targets.

Lack of harmonised data

Quantitative impact data are hard to find, making it difficult for investors to make timely, strategic decisions and compare impact across or between portfolios.

Difficult to navigate the SDG-maze

17 UN Sustainable Development Goals and 169 KPIs were designed to help companies and financial institutions align their strategies and actions with the change needed. There is an urgent need to enable SDG progress reporting.

“The need for clearly defined protocols for issuing and reporting on labelled bonds is evident. Emerging EU standards and regulations are likely to enhance issuers' reputation and improve investment opportunities.”Jane Wilkinson Independent Advisor, past member of the Technical Expert Group (TEG) on Sustainable Finance advising the European Commission, ex Head of Sustainable Finance at Luxemburg Stock Exchange

Emerging regulation

Frameworks

History of labelled bonds

2007

The UN Intergovernmental Panel for Climate Change (IPCC) publishes a report linking human action to global warming. The European Investment Bank (EIB) issues the first green bond dedicating the proceeds to renewable energy.

2008

The World Bank issues its first green bond in partnership with SEB and selected Swedish pension funds, recognizing the risk posed by climate change.

2013

The first ever green bond by a municipality is issued by SEB together with the City of Gothenburg and the world’s first green corporate bond is issued by Swedish real estate Vasakronan.

2014

The first ever green bond is issued by a government agency, Export-Import Bank of Korea. International Capital Market Association (ICMA) publishes the Green Bond Principles.

2020

Ecuador issues the world's first sovereign social bond, with the support of the Inter-American Development Bank (IDB).

2021

The European Commission launches the EU Taxonomy for sustainable activities (a classification system to help investors understand whether an economic activity is environmentally sustainable) and the voluntary EU Green Bond Standard.

2022

The labelled Bond market is worth more than USD 1 trillion with the sustainable finance market expanding to Social Bonds, Sustainability Bonds, Sustainability-Linked Bonds, Green loans, and Sustainability-linked loans.