Impact reporting to the highest standard

A one-stop solution, enabling bond issuers to showcase impact achievements to global investors.

Harmonize impact data and reporting

Global investors say current impact reporting practices are inadequate. There is a need to harmonize and aggregate impact across frameworks and indicators.

We provide corporates, municipalities, banks and sovereigns with a digital tool that standardizes impact reporting using quantifiable data.

It is easy to use and designed to help you report on impact in an efficient and compelling way.

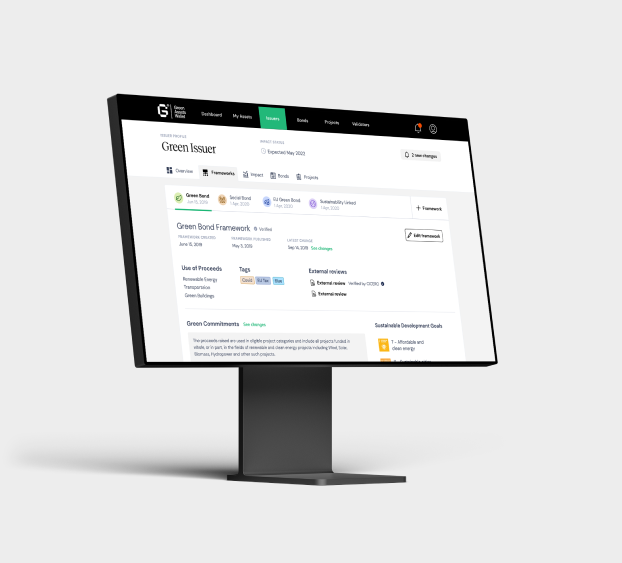

Communicate targets, project categories, and societal impact

Report on your transition targets, projects and impact delivered on framework and project level, saving you time and money.

Grow your investor base, as our platform gives you access to debt investors globally.

We help you create a unique issuer profile, onboard the platform and report on impact - all free of charge.

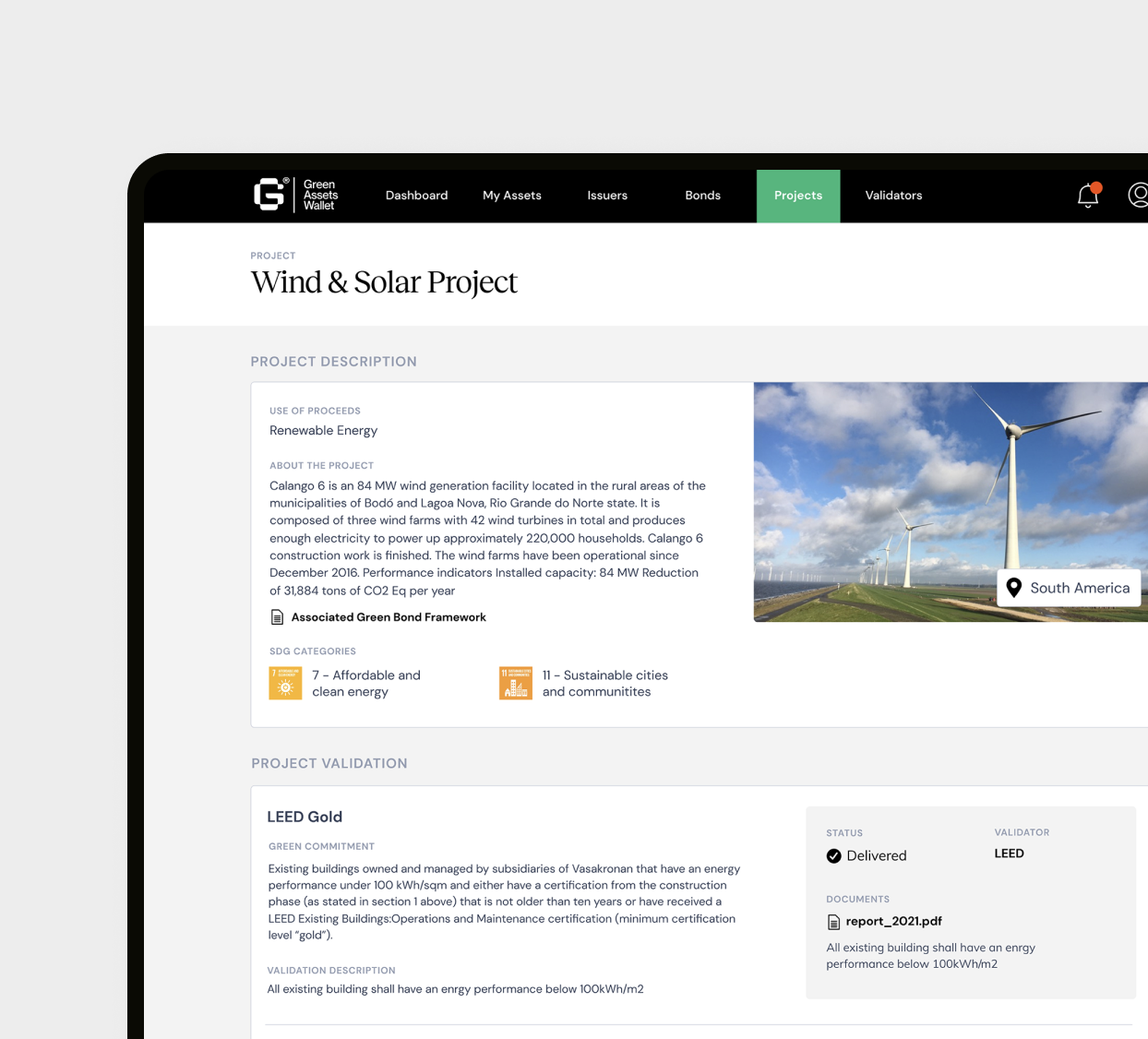

Showcase successful projects and verified results

Collect and disclose your success stories and results, in an accessible and well-structured format.

Describe your projects in detail, add satellite and other images and upload supporting documents to verify your data.

Link projects to the governing framework, overarching categories and the Sustainable Development Goals. Data and claims can also be externally verified by partnering certification bodies.

We offer

Best-in-class impact reporting

Report on impact and disclose results according to leading best-practice via our harmonized framework.

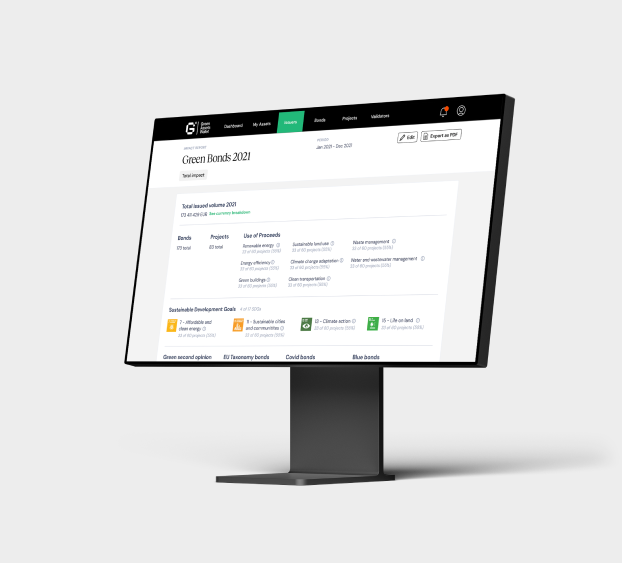

Intuitive impact visualization

Visualize your impact on framework, UoP and project level, all in one intuitive and flexible dashboard.

Validation and method disclosure

Demonstrate trust through pre- and post-issuance validation and disclose the underlying calculations and methodologies used.

Easy communication and engagement

Demonstrate credibility and attract new investors to your bonds and projects. Showcase results in your external reporting and stakeholder engagement.

Trusted by transparency leaders

Impact specialists secure success

We offer guidance to investors and issuers to report according to best practice and the Green Assets Wallet Framework. Our dedicated team of impact data specialists are keen to help.

Connecting debt capital market participants

Green Assets Wallet is an impact tech company with a mission to re-direct capital flows towards to net zero economies. Our solution injects trust and transparency into the debt capital market ecosystem through a proven methodology and harmonized and validated impact data.

Green finance in Africa

African countries are among the most exposed to climate change, but the continent only sees about 5% of global green/climate investments. Learn how Green Assets Wallet can supports issuers, investors and validators in the region.

FAQ

The time to prepare your yearly impact profile takes on average less than 30 minutes. This is subject to the quantity and granularity of data to be included. The initial onboarding and set-up of an issuer profile including company level description and information can take 10-15 minutes. Once the framework structure and related projects have been published, the uploading process of related additional data becomes more time efficient in the consecutive years.

The structure of the Green Assets Wallet’s impact reporting tool follows several world-leading reporting standards including ICMA’s reporting guidelines (to which Green Assets Wallet contributed) and the Nordic Public Sector Issuers Position Paper on Green Bonds Impact Reporting (2020). The tool has also been developed in close collaboration with market-leading labelled bond issuers, and authors of mentioned reporting standards.

Best-in-class reporting

Align impact reporting under the “Green Assets Wallet Impact Reporting Framework” for transparency and disclosure align with leading best-practice.

A one-stop solution for impact data

Collect, access, and visualize your impact data on bond and project level, all on one intuitive dashboard.

Disclose impact achievements

Demonstrate credibility and impact transparency to investors and attract new investors to your bonds and projects.

Become a leader in transparency

Demonstrate trust through a system of pre- and post-issuance validation. Create more transparency by disclosing the impact methodologies used.

Data you have recently uploaded or changed is only visible to you. Once you publish your profile and changes, investors and validators signed into the platform can view your data. Your data is never visible on the public internet, only to signed-in users.

Start by compiling your green bond documents. You will need to upload your green bond framework, second opinion, impact report and bond data to the platform. Thereafter you can create your impact profile. Info boxes next to each data field guide you along the way. There is a “Green Assets Wallet Wiki” with step-by-step instructions and you can always contact the Green Assets Wallet team using the contact form below.

Carefully consider the Green Assets Wallet definitions of each data entry point before populating the database. As reporting practices in the market are currently unstandardized, Green Assets Wallet has carefully defined each data point to create a unified reporting format on the platform. We recommend being specific in your commitments and connecting your efforts as much as possible to your overarching transition plan.

As we serve different debt market participants, ranging from investors, to issuers to validators, we offer tailored demos to showcase how Green Assets Wallet can best fit your needs.

Book a free demo with us using our contact form at the bottom of this page. We look forward to hearing from you!