A platform for impact optimization and societal returns

Green Assets Wallet is the world’s first digital platform for validating labelled bonds and reporting on societal impact.

Awarded, global and independent

Traditionally, debt capital markets have used absolute, disparate, and often qualitative ESG information to evaluate bonds and projects’ impact on society.

This way of measuring impact is limited and does not provide enough insights for investors to report on portfolio impact or assess an investment.

Green Assets Wallet is an “Impact-as-a-Service” platform. We offer an end-to-end SaaS solution, which offers the debt capital market ecosystem robust and quantifiable impact data and cutting-edge impact reporting.

Our platform

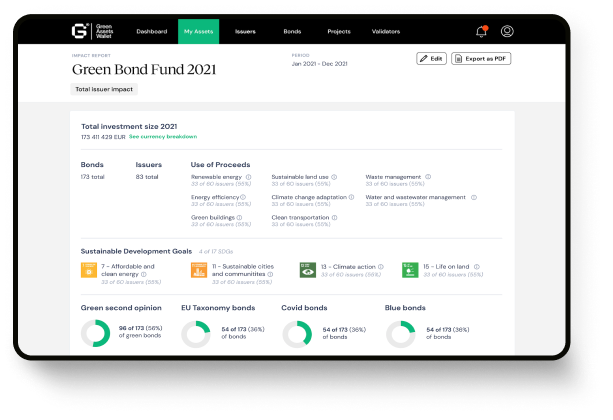

Intuitive and compliant impact reporting

Designed to address a multitude of sustainable finance regulations, while deriving maximum value from impact data and our reporting framework.

Accessible at all times

Our SaaS solution is web-based, and accessible anytime and anywhere, saving you time and money. Data are hosted in Microsoft Azure.

Customisable and user-friendly

Our user interface is intuitive and has a great design. It allows you to generate, customize, and automatize your impact data processes with one click.

Innovative technology

Our platform was originally built on a blockchain technology. We use digital imagery and satellite data. New technologies are continuously evaluated.

A leading framework

Green Assets Wallet provides a harmonized approach to impact reporting.

We offer a 90% market coverage of green bonds, and are expanding to other labelled asset classes. Our data cover 16 environmental and 6 social project categories (UoPs) and 100+ impact indicators. Data are collected globally and are harmonized, quality assured and aligned with the SDGs.

Our framework enables reporting on entity, framework, UoP and project level. It is aligned with the International Capital Market Associations (ICMA) green, social and sustainable bonds reporting guidelines, the Nordic Public Position Paper (NPSI) and the EU Green Bond standard. Green Asset Wallet also contributed to the ICMA Impact Reporting Guidelines in 2020 and are working with leading market actors to further enhance our framework.

A robust data collection process

We offer quantitative and harmonised impact data. Issuers of any size and in any market report on our platform. Data are self-reported, sourced from public impact reports, and include digital imagery and satellite data.

Impact specialists secure success

Our dedicated team of Impact Data Specialists are keen to help investors and issuers that are onboarding or reporting on our platform.

The highest data protection

Strong authentication

Single Sign on via Microsoft Azure protects your account.

GDPR compliant

Safe storage of documents, impact and user data on Microsoft Azure.