Impact investments made easy

Access trusted data, inform bond allocation choices and select high impact issuers and projects.

Months of work, done in days

Green Assets Wallet is an independent and market neutral platform offering investors a one-stop solution to reach their impact targets.

Access trusted information and impact data of assets and issuers globally. Build, benchmark, compare and assess the impact of your labelled bond portfolio - all at one click.

In short, impact reporting has never been easier and faster.

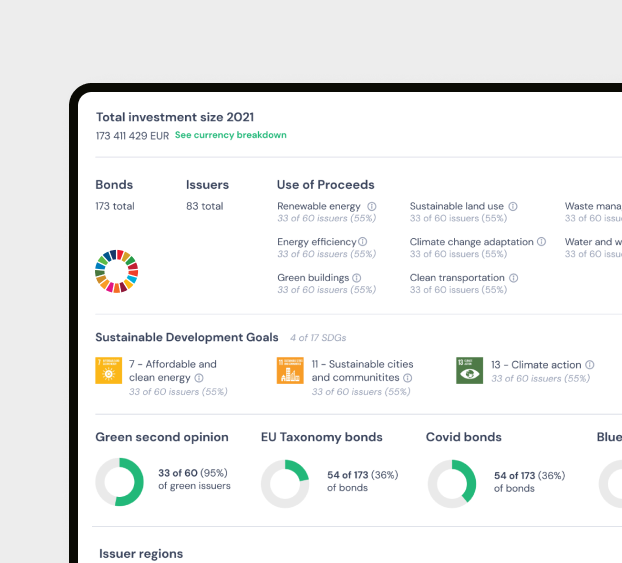

Portfolio impact, calculated and visualized

Investors face a myriad of challenges. Transparent impact reports and harmonized data are lacking in the market. Getting access to useful, relevant and qualitative data is time consuming and complex.

Green Assets Wallet harmonizes data and allows for easy access and comparison.

We help you create one or several portfolios and calculate impact on framework and project category (UoP) level. We also show how your investments align with the sustainable development goals (SDGs).

Find new investments and issuers

The limited impact data publicly available, significantly narrows the range of issuers considered for investment.

Green Assets Wallet helps you access qualitative data and discover new, high impact investment opportunities. We make asset and issuer allocation choices easy and efficient.

We also support you in communicating and visualising your results to your own investors and clients.

We offer

Access harmonized impact data

Our platform helps you standardize impact data for all issuers and securities in your portfolio. Some issuers even give access to verified impact data on project level.

Easy-to-use portfolio management tool

Our automated screening tool helps you select high impact issuers, bonds and projects. You will be able to compare and benchmark absolute and relative performance.

Access trusted and transparent issuers

Receive easy access to pre-and post issuance reports and automated tracking of issuer activities. Get direct access to second opinions, assurance reports, and project-level validation.

Intuitive impact reporting

Create detailed or consolidated impact reports in a few seconds. Disclose quantifiable performance against portfolio objectives, on framework, project or issuer level.

Trusted by transparency leaders

Impact specialists secure success

We offer guidance to investors and issuers to report according to best practice and the Green Assets Wallet Framework. Our dedicated team of impact data specialists are keen to help.

Connecting debt capital market participants

Green Assets Wallet is an impact tech company with a mission to re-direct capital flows towards to net zero economies. Our solution injects trust and transparency into the debt capital market ecosystem through a proven methodology and harmonized and validated impact data.

Green finance in Africa

African countries are among the most exposed to climate change, but the continent only sees about 5% of global green/climate investments. Learn how Green Assets Wallet can supports issuers, investors and validators in the region.

FAQ

Green Assets Wallet is an independent and market neutral platform offering investors a one-stop solution to reach their impact targets. The Portfolio Impact Reporting module supports investors to make informed investment decisions and communicate impact returns to stakeholders worldwide.

Access trusted information and impact data of assets and issuers globally. Build, benchmark, compare and assess the impact of your labelled bond portfolio – all at one click.

In short, impact reporting has never been easier and faster.

Our easy-to-use and automated portfolio screening and management tool helps you select high impact issuers, bonds and projects. You will be able to compare and benchmark absolute and relative performance.

The blockchain provides the trustworthy storage of data and therefore mediation of the relationship and transfer of information between the Issuer and the Investor. Investors are presented with a transparent means of verification of green debt deliveries. It is up to the investor to assess the trustworthiness of the validation. Validators may in turn register GAW accounts and demonstrate their trustworthiness and track record on the blockchain for issuers and investors.

On Green Assets Wallet you can find trusted and transparent issuers globally. Receive easy access to pre-and post issuance reports and automated tracking of issuer activities. Get direct access to second opinions, assurance reports, and project-level validation.

Our platform helps you standardize impact data for all issuers and securities in your portfolio. You will be able to generate quantifiable harmonized impact data from issuers across the globe. Some issuers even give access to verified impact data on project level.

Our intuitive impact reporting dashboard creates detailed or consolidated impact reports in a few seconds. Disclose quantifiable performance against portfolio objectives, on framework, project or issuer level.

The structure of the Green Assets Wallet’s impact reporting tool follows several world-leading reporting standards including ICMA’s reporting guidelines (to which Green Assets Wallet contributed) and the Nordic Public Sector Issuers Position Paper on Green Bonds Impact Reporting (2020). The tool has also been developed in close collaboration with market-leading labelled bond issuers, and authors of mentioned reporting standards.