Dear friends and colleagues,

this year has been very different for all of us. The pandemic has caused us to rethink, take stock and give back. At Green Assets Wallet most of what we do is about giving back.

Without you we would not exist. Our vision for impact at scale is only possible with the shared efforts of you, everyone in the broader ecosystem we aim to engage.

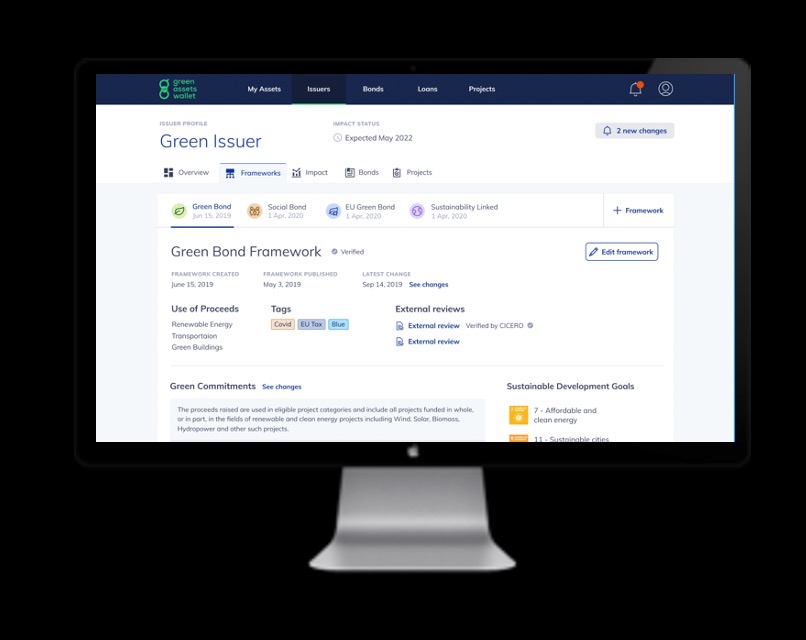

Much has changed for us at Green Assets Wallet in 2021. We have ramped up and transformed from an innovation project to an agile company and business. Today we engage issuers and investors worldwide through the hearts and hands of 20+ team members.

As we make big strides towards becoming the impact intelligence leader in the space, we would like to highlight some of the achievements from the past year and thank you all for your contribution!

We would like to wish you all mindful holidays and a good start into the New Year.

We are ready to welcome 2022 full of energy and hope you are too.

See you in 2022!

With the very best wishes,

The Green Assets Wallet Team